Back to Latest

The Department Of Energy’s Loan Program Office (LPO) was created via the Energy Policy Act of 2005, but chances are, you heard more about it in the last four years than you had heard throughout the entire 15 years prior– and for good reason.

Over the last four years:

- The Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL) significantly increased LPO’s lending authority and expanded the scope of the office’s focus areas;

- Jigar Shah was appointed to lead the LPO, bringing significant publicity to the office thanks to Jigar’s stature in the cleantech industry as a founder of both Generate Capital and SunEdison; and

- The tightening of the fundraising environment for cleantech companies – along with sustained high interest rates – forced creativity on the part of companies to find other sources of capital.

These conditions have led to unprecedented levels of investment– the office obligated $38B in 2023. With the recent flurry of activity following the election, many cleantech companies may be wondering and even worrying about whether the incoming administration may curb funding opportunities for their business.

PVG can’t tell you how the LPO will change under the new administration, but through our work with clients over the last four years, we can tell you that the LPO has always been one tool in the cleantech financing toolbox. And just like a hammer, it is not the right tool for every project.

How to know whether your project is a good fit for LPO funding:

In our experience we’ve found that more often than not, the LPO’s Title 17 Clean Energy Financing is not the right funding source for an organization. That’s especially true if:

- You are trying to justify manufacturing in the US. The LPO has always been focused on funding strong business models. While on-shoring has been a big priority for the Biden administration broadly, the goal of onshoring alone is not a “market challenge” the LPO is seeking to address in its Title 17 Clean Energy Financing.

- You don’t have offtake agreements in place for ~50% of your production.

- Your product sales depend on consumer adoption. The LPO is seeking projects with a clear line of sight to strong financial performance and predictable offtake or cash flows. Predicting consumer behavior is challenging, particularly if you are in a new product category where demand is generally unproven. Based on historical data, the LPO has primarily invested in projects that do not depend on consumer uptake.

- Your project is already available commercially. Title 17 Clean Energy Financing is specifically focused on supporting emerging technology. The LPO has therefore defined “innovation requirements” that focuses eligibility on technology that is not yet widely available (learn more here).

There has to be dependable cashflows...this can come a number of different ways...but if there is no contract and no [sales] history....

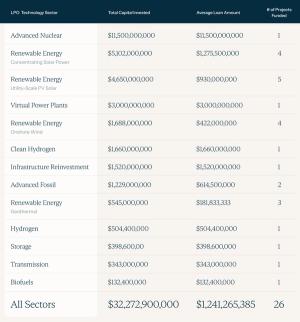

We can see evidence of the types of projects the LPO does (and does not) fund by looking at data from the last 15 years. While we see significant sector diversity across LPO Title 17 investments we also see minimum nine-figure investments.

In short, unless your project needs $100M in funding and is in the Goldilocks zone of novelty – too new for big banks but not new enough for VCs – your time is probably better spent finding funding elsewhere.

Some project types will indeed (and probably should) lament a changing LPO, but it should also be clear that the vast majority of cleantech projects and companies are not the right fit for LPO. The good news is that many of the funding sources that existed for non-LPO cleantech companies during the Biden administration will likely still exist under the new administration.

Where to go from here:

Let’s propose a hypothetical situation (for some readers, this may not be so hypothetical).

You are a start-up with tech that doesn’t need $1B for your next project, but a check size from $5M-$50M is critical for launching a pilot, a major capital expenditure or new market entry. Your technology is proven – there is no longer tech risk – but it is new enough that there isn’t a solidified offtake market. Or maybe you supply consumer products, so offtake was never an option. LPO isn’t a good fit for funding– where should you look besides equity?

- Bank debt may become more attractive if rates continue to come down, but there is a risk a bank may not approve a loan. Even if the bank does approve the loan, the downside risk associated with debt may be too much to bear.

- Alternative federal funding or grants will remain available after January 20th. The new administration is unlikely to curtail the Greenhouse Gas Reduction Fund (GGRF) and awardees are highly motivated to deploy capital. NCIF awardees Climate United, Coalition for Green Capital (CGC), Power Forward Communities, and their sub awardees, all have funding opportunities. Some, including CGC and Elemental Impact, have already released project-level RFPs.

- State programs and Green Banks may also suit your needs. NYSERDA and the California I-Bank are two notable examples of state-funded capital providers for cleantech (learn more about Green Banks here and here).

Bottom line:

The Loan Program Office always was, and always will be, meant for big technology projects that have based the “high-risk” phase, need significant funding ($100M+), and can only attract funding in the private markets if they have a loan guarantee. Changes to the LPO over the next four years are unlikely to affect the majority of cleantech companies. For most of you, there are better funding sources to meet the needs of your business.